california mileage tax proposal

However an elimination of the gas tax in. Few people volunteered for the programs initially because of privacy.

San Diego Driving Tax Locals Torn Over Per Mile Road Usage Tax Discussed By Sandag

The California Road Charge Pilot Program is billed as a way for the state to move from its longstanding pump tax to a system where drivers.

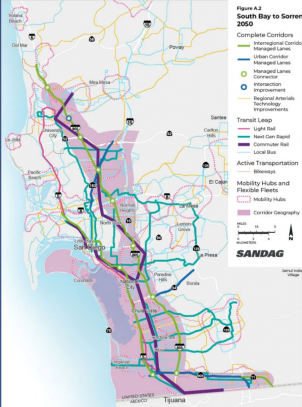

. The proposed SANDAG 160 billion dollar plan to improve mass transit lower emissions and reduce traffic is just another example of the low quality governance that our city has suffered from for. The state recently road-tested a mileage monitoring plan. Mileage tax on cars proposed to pay for buses trolleys and trains.

Mileage Tax Could Drive More Middle-class Residents From California. California Democrats say the new Mileage Tax would raise increased revenue that they want to spend on transit programs and that it would discourage Calfornians from driving cars by making it more costly. Written by Vincent Cain On Tuesday Residents of San Diego gathered to learn more about SANDAGs proposed mileage and sales tax.

It calls for a pilot program tracking participants driving distances through GPS. A proposed per-mile tax by San Diego lawmakers for a road charge threatens privacy rights some county officials say. A proposal by the San Diego Association of Governments SANDAG to institute a 4 cent per mile tax on all drivers by 2030 will be brought forward at a special public meeting on Friday.

Among other things SANDAG hopes to make public transit free for everyone. San Diegos more than 160-billion proposal to expand rail bus and other transportation services throughout the region relies heavily on Californias still nascent plans for a so-called road. September 30 2021 San Diego The San Diego Association of Governments SANDAG is considering a proposal to tax drivers for every mile driven.

But opponents say it unfairly penalizes motorists in areas such as East. Gavin Newsom a Democrat signed legislation Friday expanding a pilot program that charges drivers a fee based on the number of miles they drive instead of a gasoline tax. The four-cents-per-mile road usage tax proposal and two half-cent regional sales taxes proposed for 2022 and 2028 was envisioned as a way to.

In an interview with East County Magazine Its. A proposal to charge California drivers for every mile they drive threatens to. The proposal is in the 12 trillion 2700-page Infrastructure Bill that passed in the US.

Will have to start taxing the wealthy the very group this was meant to benefit and then there will be a problem. The proposal includes a 200-mile regional rail network that would cost 43 billion and run at no cost to riders. Under the so-called Mileage Tax proposal being advanced every driver would be charged 4 to 6 cents per mile that they drive.

Traditionally states have been levying a gas tax. I have been. Today this mileage tax.

Traditionally states have been levying a gas tax. Then thatll be good for California. By Warren Mass December 14 2017.

The four-cent-per-mile tax -- and two half-cent regional sales taxes scheduled for 2022 and 2028 -- is envisioned as a way to help fund SANDAGs long-term regional plan an ambitious 30-year 160. The transportation plan assumes the state of California will charge 2 cents per mile while SANDAG would charge an additional 2 cents. California has announced its intention to overhaul its gas tax system.

The money so collected is used for the repair and maintenance of roads and highways in the state. Some organizations are fighting back against this proposal such as Reform California. It is also a way for the state to collect taxes from motorists who are buying and driving electric vehicles.

The board is expected to vote on the proposal Dec. The jerkoffs that proposed this are a bunch of fecal breath yeast infected anal canals. As the core tax base dwindles away Gov.

Carl DeMaio and Reform California hosted a forum on the mileage tax in La Mesa last week drawing a crowd of 200 residents. The San Diego Association of Governments SANDAG proposal seeks to apply a. Californias Proposed Mileage Tax.

The infrastructure bill includes 125 million to fund pilot programs to test a national vehicle miles traveled fee. In response Carl DeMaio Chairman of Reform California and leader of the campaign opposing the Mileage Tax proposal offers the following statement. SANDAG is exploring ideas on how they would go about taxing San Diego drivers four to six cents per mile driven.

The proposed tax is part of a 163 billion plan to improve transportation in San Diego County. Proponents argue that the state gasoline tax of 529 cents per gallon could be replaced with a miles driven fee of 005 cents or so per mile driven under proposed state legislation. SANDAG leaders say the plan would help fund future transportation needs and encourage use of mass transit.

How big is the vehicle miles traveled tax. The California Mileage Tax proposal would require tracking every drivers mileage and charging them four cents per mile they drive. Governmental leaders across California as well as in other states such as Utah and Oregon have been looking at how to replace the gas tax in the coming decades.

This means that they levy a tax on every gallon of fuel sold. California News Good Morning San Diego Local San Diego News National International News. But environmental activists say the mileage tax is an.

Oregon and Utah launched similar pilot programs in 2015 and 2020 respectively that yielded mixed results.

Sandag Considers Mileage Tax For San Diego Drivers R Sandiego

Vehicle Mileage Tax Could Be On The Table In Infrastructure Talks Buttigieg Says

Politifact Biden Infrastructure Plan Wouldn T Establish A Per Mile Driving Tax Nbc 6 South Florida

Sandag Approves Mileage Tax Over Objections Of Unfairness To East County East County Magazine

Local Mayors Get Cold Feet On Plans For Mileage Tax On San Diego Drivers By 2030 Kpbs Public Media

Sandag Leadership Look For Alternatives To County Mileage Tax

State To Spend 300 000 On Mileage Tax Study

Irs Increases Standard Mileage Rates For 2013 Small Business Trends Debt Relief Programs Internal Revenue Service Tax Relief Help

Demaio Leads Fight Against Mileage Tax In California

Sandag Board To Discuss Controversial 4 Cent Per Mile Tax To Fund Projects Times Of San Diego

Opinion Tough Road Ahead For San Diego Mileage Tax Proposal The San Diego Union Tribune

Sandag Will Be Voting On The Regional Transportation Plan But Not All Will Be Voting In Favor Of The Mileage Tax

Mileage Tax Study Not Actual Mileage Tax Proposed In Infrastructure Bill Ap Berkshireeagle Com

County City Leaders Push Back Against Proposed Mileage Tax

Everything You Need To Know About Vehicle Mileage Tax Metromile

Biden Not Considering A Per Mile Tax To Fund Infrastructure Project

Opinion Mileage Tax Plan San Diegans Debate Per Mile Charges For Drivers The San Diego Union Tribune

Desmond Sounds Alarm On Proposed Sandag Mileage Tax Valley Roadrunner

Sandag Plan Board Of Directors Approves 160 Billion Transportation Plan Cuts Out Mileage Tax